Table of Contents

Why Traditional KPIs Fall Short

Most eCommerce KPI dashboards are cluttered with vanity metrics - metrics that look good but tell you almost nothing about profitability. Metrics like impressions, click‑through rate (CTR), and even ROAS are popular because they’re easy to surface, but they aren’t designed to answer the real question: Is your marketing driving profit?

The Difference Between Revenue Metrics and Profit Metrics

- Revenue metrics (like ROAS) tell you top‑line output - revenue generated per dollar spent.

- Profit metrics tell you bottom‑line contribution - how much profit remains after all costs.

Without tracking profitability, brands can fall into traps like:

- Spending heavily on ads with high ROAS but low margin

- Optimising for conversions without regard to customer value

- Focusing on opens and clicks without revenue attribution

To truly manage eCommerce growth, you need KPI systems that:

- Tie to unit economics

- Reflect customer economics (CAC, LTV)

- Are actionable on weekly and monthly cadences

- Improve decision‑making for investment, optimisation, and scaling

This guide gives you a robust framework to do exactly that.

KPI Fundamentals: The Economics Behind Profit

Before we define specific KPIs, let’s establish the core economic concepts that KPIs should measure.

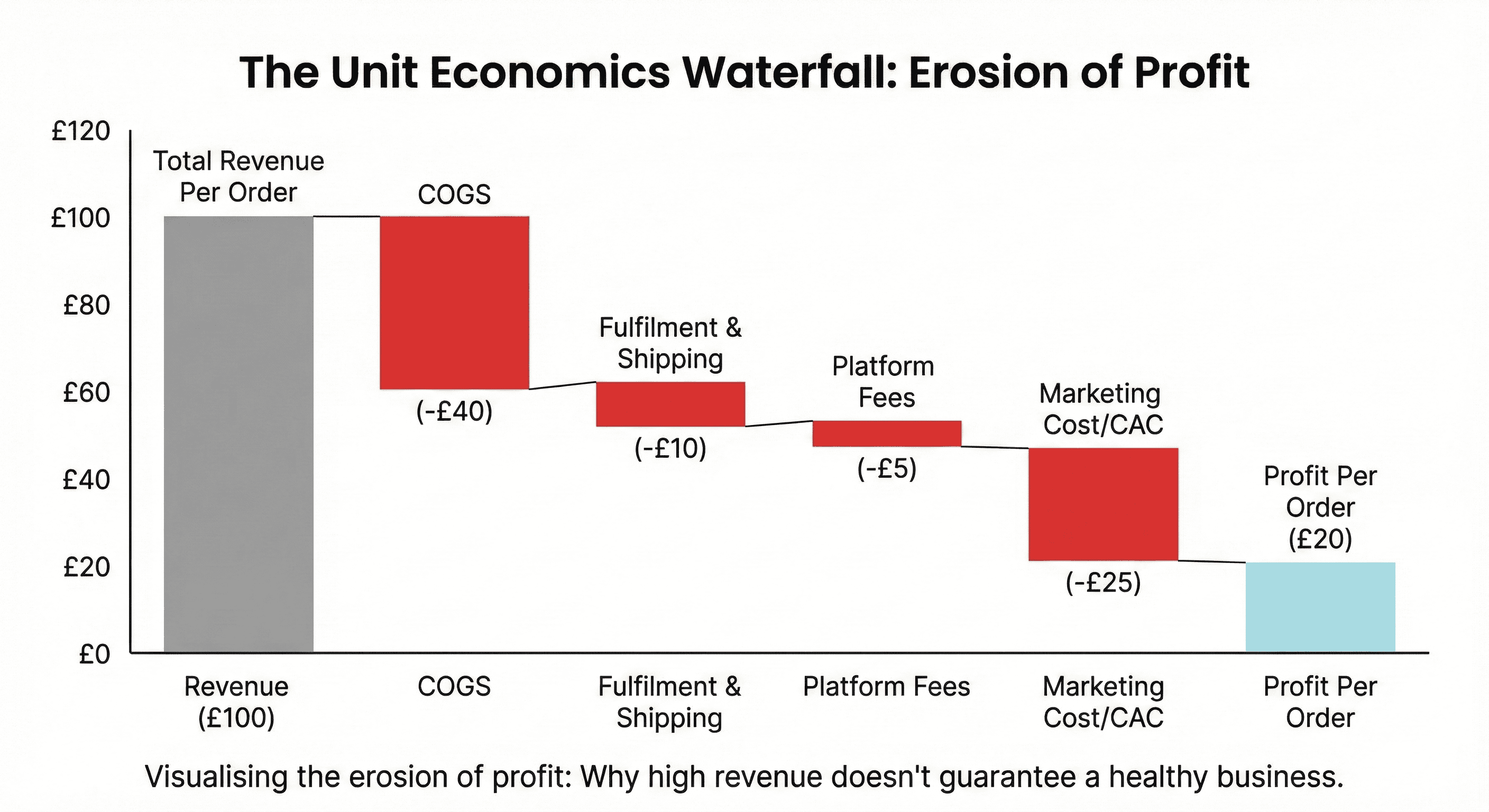

Unit Economics: The Bedrock of Profitability

Unit economics means understanding the profit and loss associated with a single customer or transaction.

Key components:

- Revenue per order

- Cost of Goods Sold (COGS)

- Fulfilment & shipping costs

- Marketing & ad spend attribution

- Platform and payment fees

Profit per order = Revenue − (COGS + Fulfillment + Fees + Attributed Marketing Cost)

This single formula drives almost every KPI that matters.

Customer Lifetime Value (CLV or LTV)

Customer Lifetime Value projects the total gross profit a customer is expected to generate over their “lifetime” with your brand.

There are several ways to calculate LTV:

- Historical LTV: based on past purchase behaviour

- Predictive LTV: uses modelling and cohort behaviour

- Segmented LTV: calculates by channel or campaign

Simple LTV formula (Basic): LTV = Average Order Value × Purchase Frequency × Gross Margin

This helps balance acquisition investments (CAC), especially when determining sustainable growth.

Contribution Margin vs. Gross Margin

- Gross Margin = (Revenue − COGS) / Revenue

- Contribution Margin = (Revenue − All Variable Costs) / Revenue

Contribution margin matters because it measures what’s left to cover fixed costs and deliver profit.

The KPI Stack That Predicts Profit

We’ll break KPIs into three channel systems: Paid, Organic, and Email. For each, you’ll get:

- Definitions

- Why it matters for profit

- How to calculate it

- Benchmarks

- How to interpret & optimise

Paid Marketing KPIs

Customer Acquisition Cost (CAC)

Definition: The average cost to acquire one customer through a specific channel or campaign.

Formula: CAC = Total Marketing Spend / Number of Customers Acquired

Example:

If you spent £20,000 on ads and acquired 400 customers, CAC = £20,000 ÷ 400 = £50

Why It Matters:

CAC tells you how much you’re paying for each new revenue generator. Paired with LTV, CAC tells you if your acquisition is profitable.

Target Rules of Thumb:

- LTV:CAC of 3:1 is generally healthy

- LTV:CAC of >4:1 is ideal for scaling

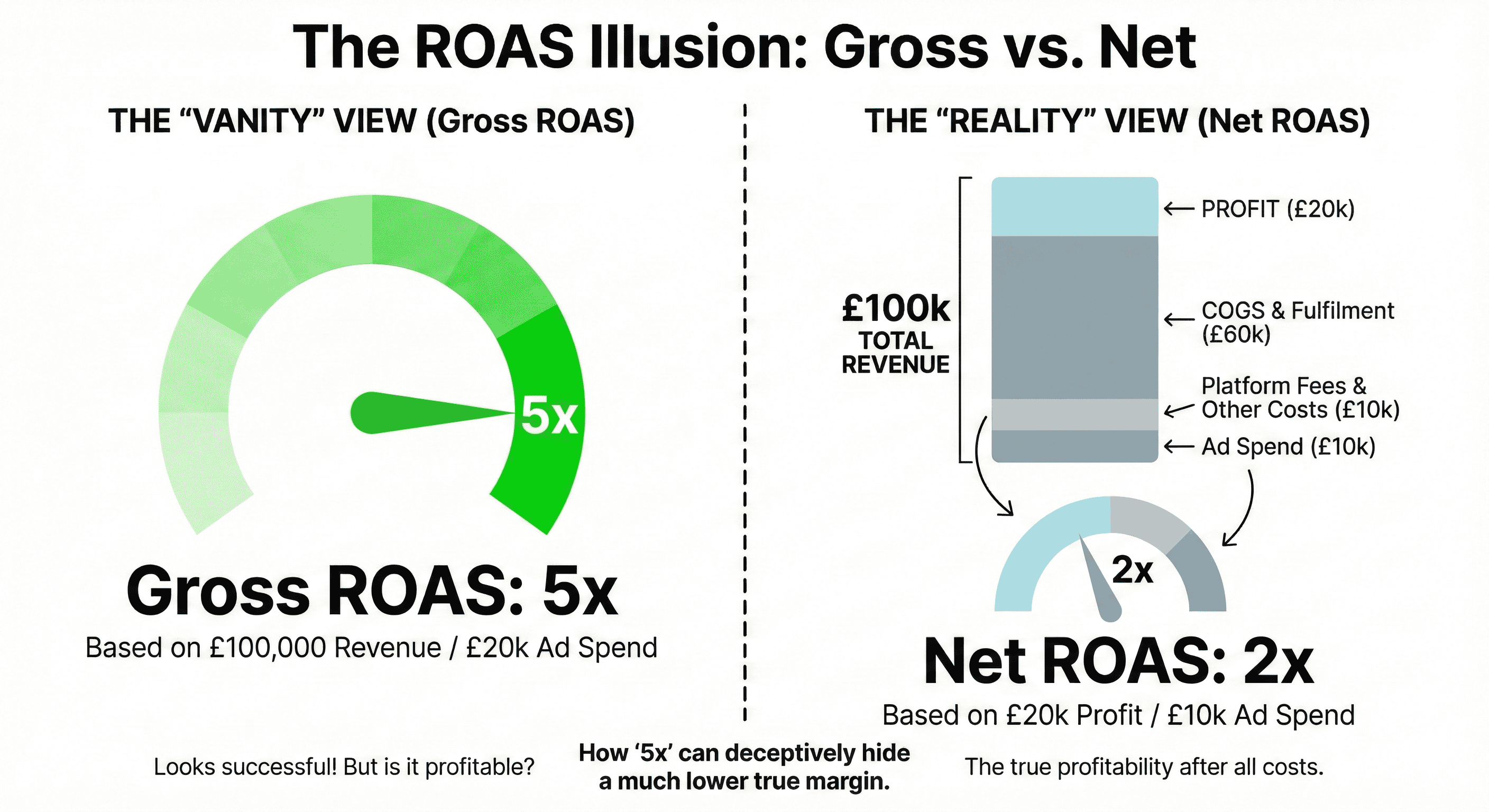

Gross ROAS vs. Net ROAS

Gross ROAS

Definition: Return on Ad Spend - total revenue per ad dollar.

Formula: Gross ROAS = Revenue from Ads / Ad Spend

Example:

£100,000 revenue from £20,000 spend → Gross ROAS = 100,000 / 20,000 = 5x

But does that mean profit? Nope.

Net ROAS - The Profit‑Focused Version

Definition:

Return on Ad Spend after subtracting all campaign‑related costs including COGS, fulfilment, fees, and attribution model costs.

Formula: Net ROAS = (Revenue − COGS − Fulfilment − Fees) ÷ Ad Spend

Example:

Revenue = £100,000

COGS + Fulfillment + Fees = £60,000

Ad Spend = £20,000

Net ROAS = (100,000 − 60,000) ÷ 20,000 = 2x

This tells you that for every £1 spent, you’re earning £2 in gross profit, not just revenue.

Profit Inference: If your net ROAS < 1, you lose money per ad dollar.

Why Net ROAS Matters:

Gross ROAS can be high even if margins are razor‑thin. Net ROAS reveals the truth.

Benchmark Targets:

- Net ROAS ≥ 2x is a basic profitability signal

- Net ROAS ≥ 3x is strong performance

Effective CAC (eCAC)

Definition: CAC adjusted for return rate, refund impact, and customer churn.

Adjusted CAC = (Ad Spend + Refunds − Returns Offset) / Customers

This more conservative CAC ensures you’re not overestimating profitability.

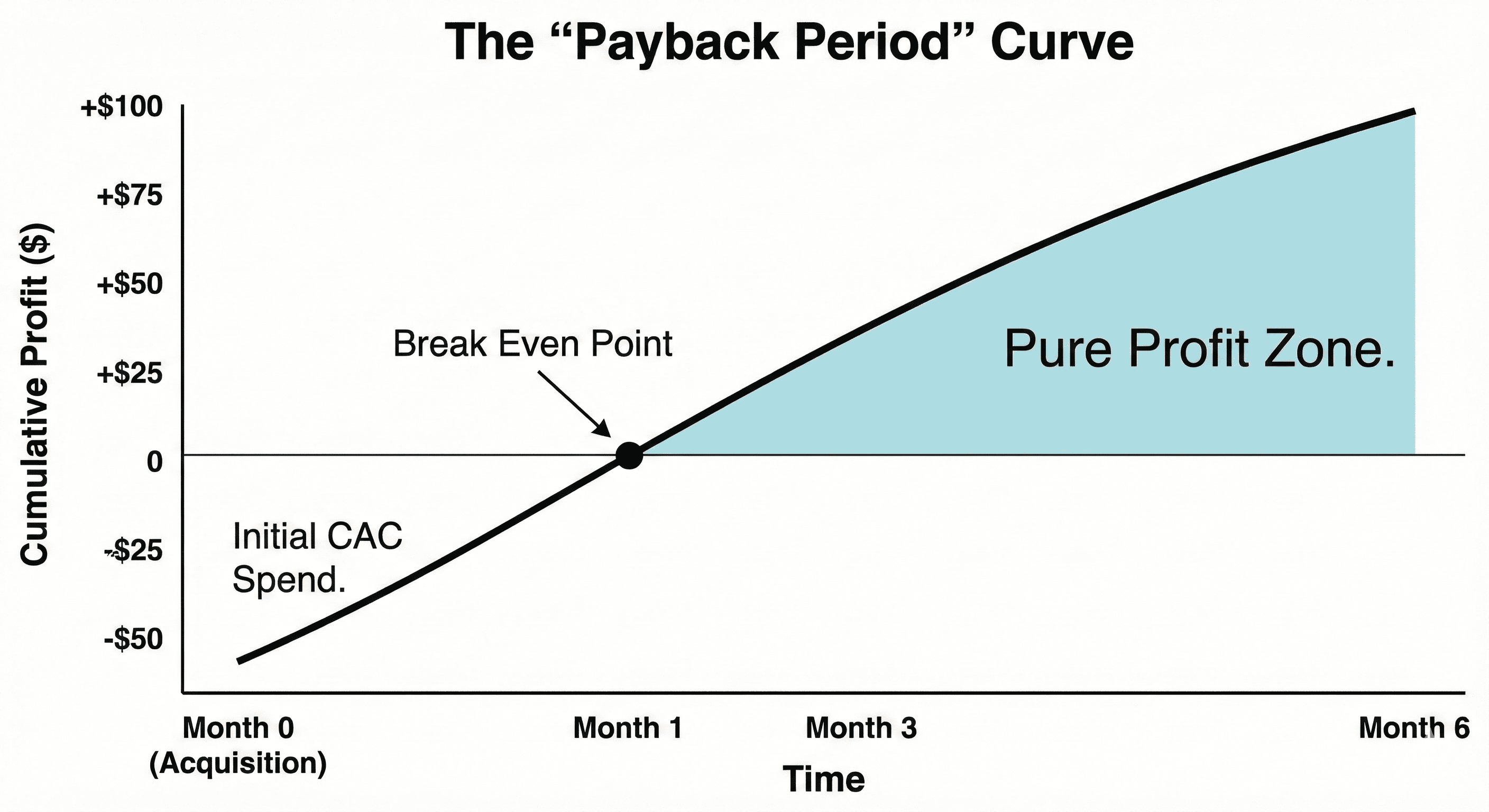

Payback Period

Definition: The time it takes for the profit from a customer to cover the CAC.

Formula: Payback Period = CAC / (Revenue per Customer × Gross Margin)

This predicts cash flow and informs budget pacing.

Cumulative Incremental Value (CIV)

Definition: Revenue caused by the campaign beyond what would have happened organically.

Tools & Models:

- Incrementality testing

- Holdout/control groups

Strictly required if you want your paid KPI modelling to avoid counting cannibalised conversions.

Organic Marketing KPIs

Organic Conversion Rate by Landing Page

Formula: Organic Conversions / Organic Sessions

Why It Matters: Shows which pages are profit contributors vs traffic generators that don’t convert.

Organic Average Order Value (AOV)

Formula: Organic Revenue / Organic Orders

Higher AOV often correlates with higher margin because organic traffic usually has higher intent.

Organic Funnel Progression Rate

Track how many visitors who enter through organic discovery ultimately purchase.

Search Visibility + Click‑Share

Use tools like GA4 + Search Console to measure actual clicks-to-revenue, not just impressions.

Email Marketing KPIs

Revenue Per Email Sent (RPE)

Formula: Total Revenue from Email / Number of Emails Sent

This is the true email ROI metric - clicks and opens don’t tell you revenue impact.

Targets:

- Small store: £0.50–£1.20 RPE

- Large store with segmented flows: £1.20–£3.00+

Repeat Purchase Rate (Email Cohort)

Formula: Customers with ≥2 purchases via email / Total email‑acquired customers

This directly ties email to retention value.

Email Engagement to Revenue Fraction

Percentage of total revenue from the email channel - a high indicator of brand loyalty.

Reporting Frameworks: Weekly, Monthly, Quarterly

Profit prediction is not just about tracking - it’s about frequency and context.

Weekly Framework

Weekly reporting provides tactical insights:

- Detect campaign performance swings

- Find early signs of optimisation opportunity

- Spot margin compression before it hurts

Track weekly:

- CAC per channel

- Net ROAS

- Conversion trends by source

- RPE

- Incrementality signals from tests

Monthly Framework

Monthly reporting adds strategic context:

- Trend smoothing

- Retention and customer quality

- LTV movement

Track monthly:

- Customer quality cohorts

- Repeat purchase rate

- Payback period trends

- Cumulative margin contribution

How to Build Your Lean Profit‑Predictive KPI Dashboard

Recommended Tools:

- GA4 (source-level insight)

- Post‑purchase surveys (incrementality)

- Email platform reporting (RPE)

- LTV/Cohort tools (Lifetimely, Triple Whale)

- Looker Studio Dashboard (cross-channel KPIs)

Dashboard Templates

Examples you might build:

- Paid KPI view: CAC vs Net ROAS vs Payback

- Organic KPI view: AOV vs Conversion vs Funnel Leakage

- Email KPI view: RPE vs Repeat Rate vs Lifetime Revenue

Pitfalls to Avoid

- Tracking CTR obsessively - doesn’t correlate with profit

- ROAS without margin data - misleading optimism

- Fragmented dashboards - siloed insight loses context

Advanced Techniques: Forecasting & Attribution

- Predictive LTV modeling

- Markov chain attribution for multi‑touch insights

- Holdout campaigns for true incrementality

Conclusion: KPI Discipline = Profit Confidence

When you focus on eCommerce metrics tied to margin, acquisition efficiency, and customer value, you transform dashboards from noise into profit steering instruments.

This isn’t just tracking - it’s managing eCommerce as a business with cashflow discipline.

Frequently Asked Questions

What is the most profit‑predictive KPI in eCommerce?

Net ROAS - because it adjusts revenue for all linked costs.

How often should I evaluate CAC?

Weekly for campaign pacing; Monthly for trend and scaling decisions.

Does high organic traffic predict profit?

Only if it converts at above the profit threshold and leads to repeat purchases.

Get in touch today

complete the form below for an informal chat about your business

.png)

.png)

.png)